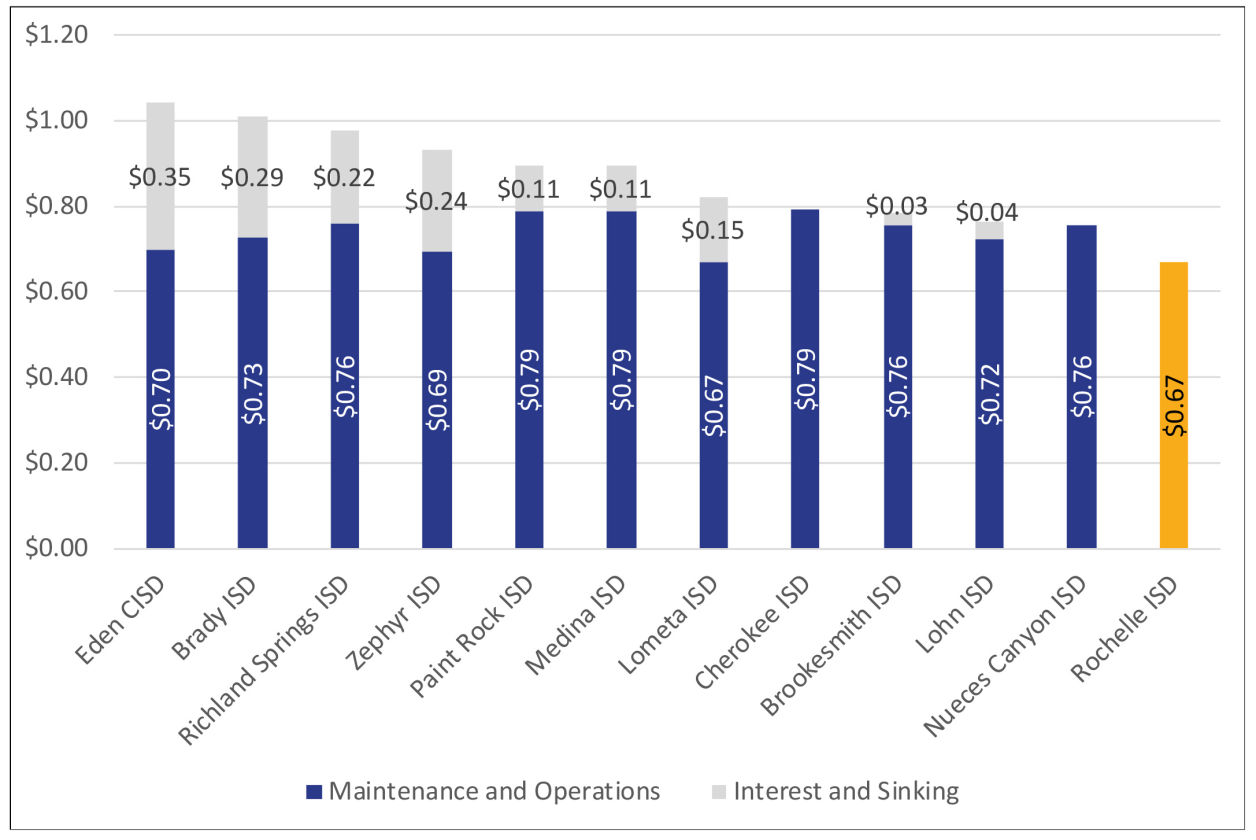

How is the District’s tax rate configured?

A school district’s tax rate is comprised of two components: the Maintenance & Operations tax (M&O) and the Interest & Sinking tax (I&S). The M&O tax is used to operate the school district, including salaries, utilities, furniture, supplies, food, gas, etc. The I&S tax can only be used for the repayment of bonds. Bond sales only directly affect the I&S rate.